View and read the Types of Power of Attorney in order to get a better understanding of which form(s) are best.

Valid for a temporary period of time, usually between six (6) months to one (1) year, which is dependent on the State’s laws.

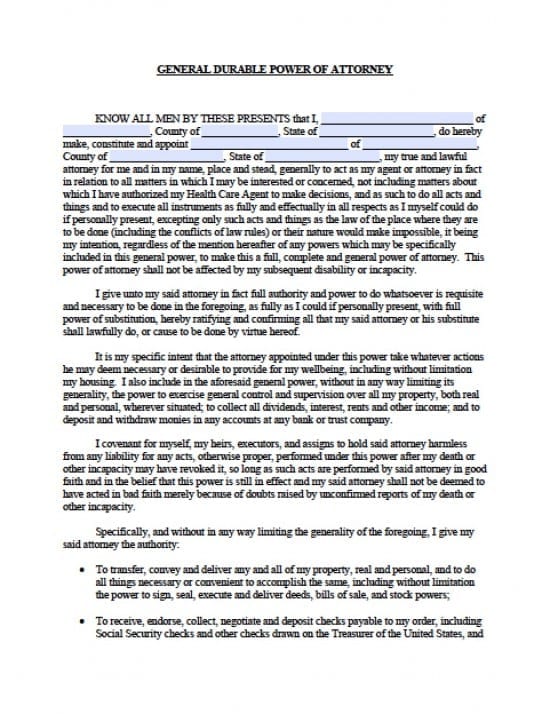

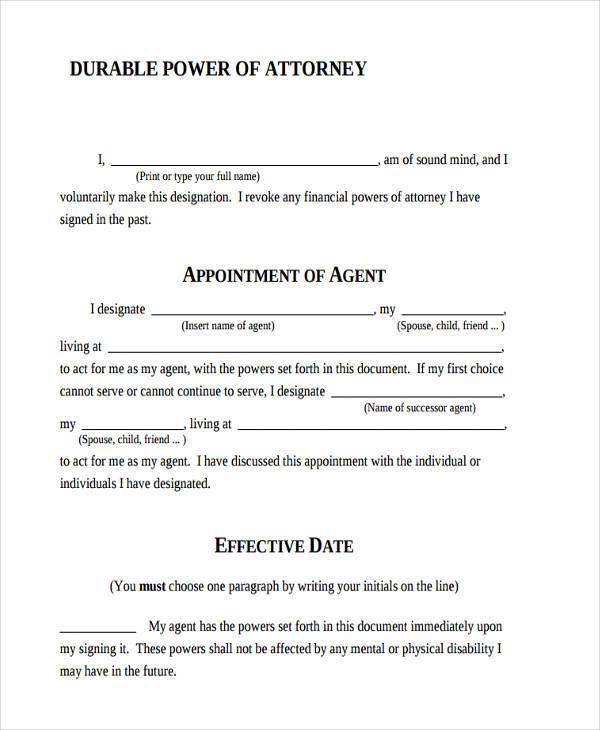

FINANCIAL DURABLE GENERAL POWER OF ATTORNEY FULL

Minor Child Power of Attorney – Allows a parent to give the full responsibility of their son or daughter to someone else (except for adoption rights). Medical (Health Care) Power of Attorney – Used by an individual to select someone to handle their health care decisions in the chance they are not able to do so on their own. Limited Power of Attorney – Permits a person to carry out a specific activity on the principal’s behalf either as a one (1) time occurrence or for a specific period of time. 2015, allows an individual or business entity to elect a party, usually an accountant or tax attorney, to file federal taxes on their behalf. IRS Power of Attorney (Form 2848) – Revised in Dec.

General (Non-Durable) Power of Attorney – Grants the same financial powers listed in the durable form except that it does not remain in effect if the principal becomes incapacitated or mentally disabled. By StateĪdvance Directive – Used for health care planning and combines a medical power of attorney and a living will.ĭownload: Adobe PDF, MS Word, OpenDocumentĭurable (Financial) Power of Attorney – The most common type of power of attorney, allows a person to grant someone else the unrestricted ability to handle financial transactions on behalf of the principal. Signing Requirements – Must be signed under state law with either two (2) witnesses, notarized, or both.

0 kommentar(er)

0 kommentar(er)